OPPORTUNITY ZONE

The Opportunity Zone Program is a tax incentive established in the Tax Cuts and Jobs Act of 2017, designed to encourage long term investment in “distressed communities.” It does this by allowing investors to re-invest current capital gains in those areas in an extremely tax-advantaged manner while also limiting the the capital gains liability on the funds investment.

HOW IT WORKS

An investor who has triggered a capital gain by selling an asset like stocks or real estate can receive special tax benefits if they roll that gain into an Opportunity Fund within 180 days. There are three primary advantages:

WHY INVESTMENT

Qualifying investments offer three unique and compelling tax advantages – investors can defer paying federal capital gains tax from recently sold investments until December 31, 2026, reduce that tax payment by up to 15%, and pay as little as zero taxes on their Opportunity Fund investment if held for 10+ years. Investors can also help spur economic growth in historically under-invested neighborhoods.

Investors may defer capital gains tax on any recently sold investment such as the sale of stocks, bonds or real estate, so long as those gains are rolled over into an Opportunity Fund investment within 180 days of sale.

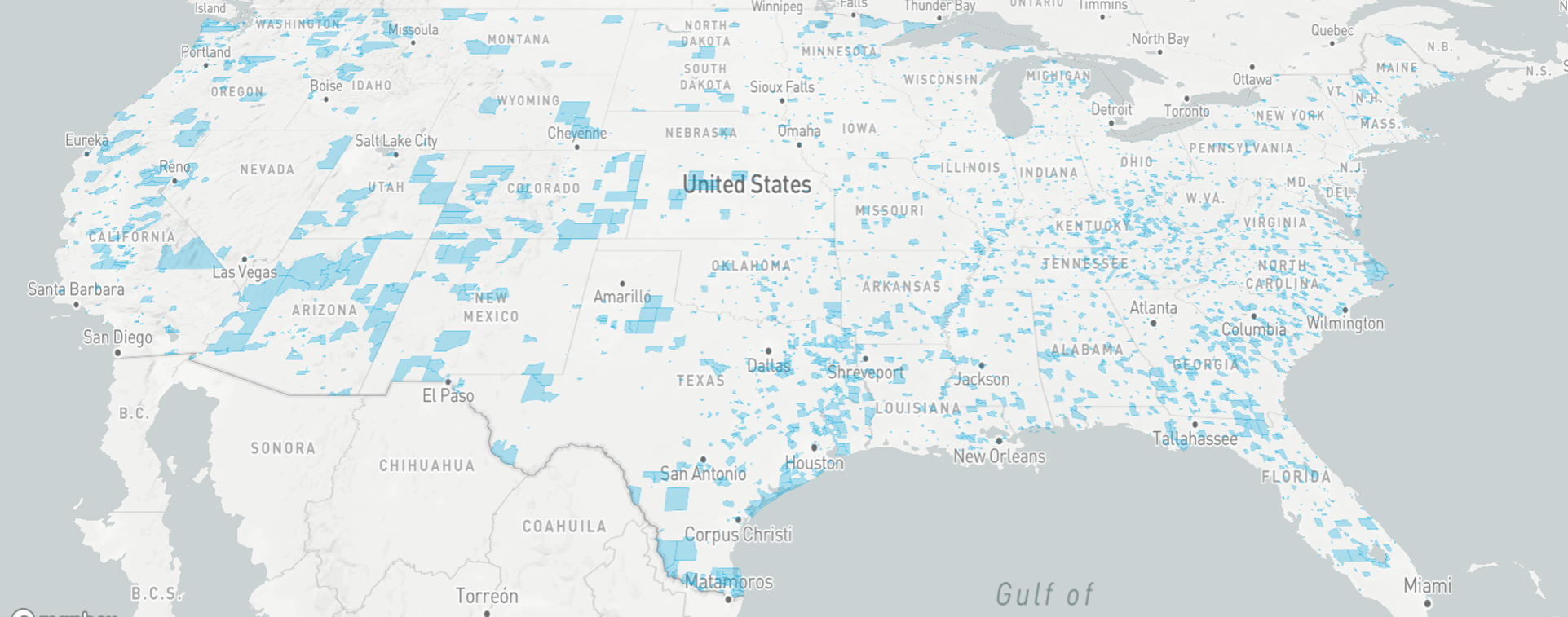

OPPORTUNITY ZONE LOCATIONS

Opportunity Zones can be found all across the country in urban, suburban and rural areas. Drawing from governmental data sources, the map below is a powerful resource for investors and real estate firms to better understand Opportunity Zones. Use the map to see how these zones are distributed throughout the U.S. or look up a specific address to find out if falls within a designated Opportunity Zone.